Master Auction Market Theory using Order Flow & Volume Profile 100% FREE.

Join our Skool Community below to get started, no strings attached!

poxisFX

Empowered Trader's Academy

Learn how professional traders read price through auction dynamics, orderflow, and institutional behavior.

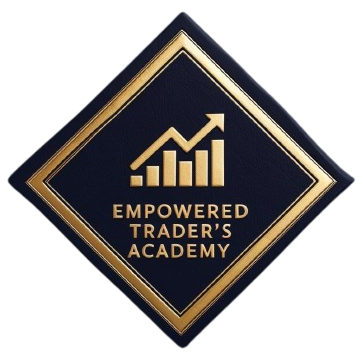

Master Auction Market Theory

Learn how markets find value, spot where buyers and sellers agree, and trade the same dynamics the pros use

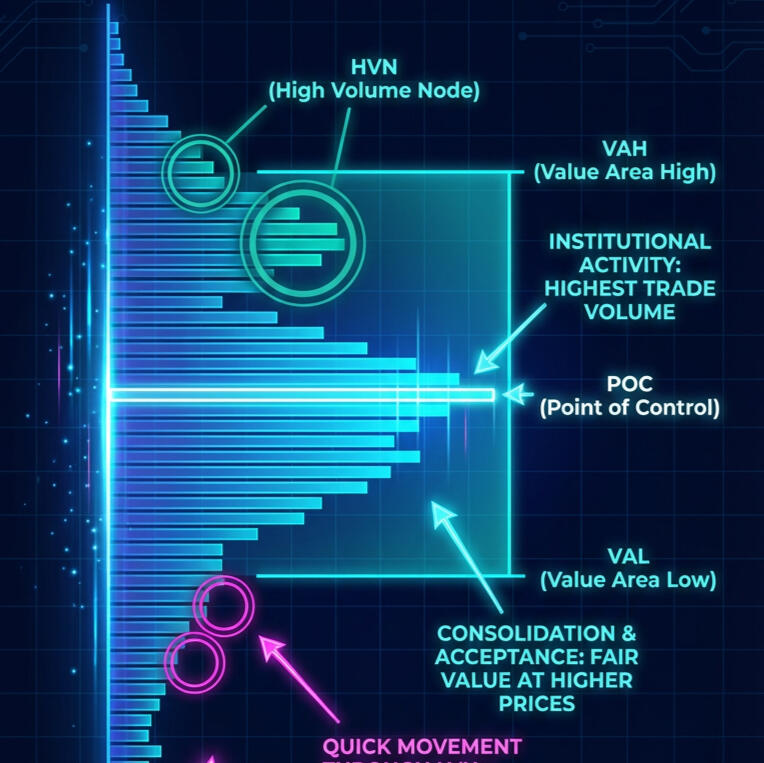

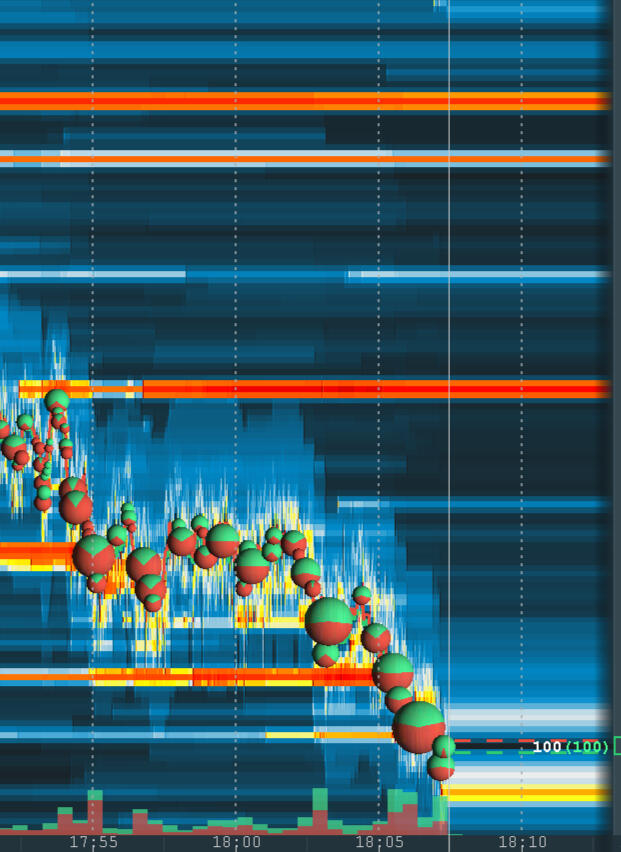

Learn Order Flow

Orderflow shows you what candlesticks alone hides.

Learn how aggressive buyers and sellers step in, where absorption occurs, and how to time entries with precision using real market participation.

Learn Advanced Supply and Demand

Find the zones institutional players actually use, filter out the false levels, and trade setups where smart money prefers to act.

Learn how to trade with structure and a proven edge

No random setups. No emotional trades. You’ll learn a structured framework that defines market context, execution criteria, and risk management, so every trade has a clear reason and repeatable edge.

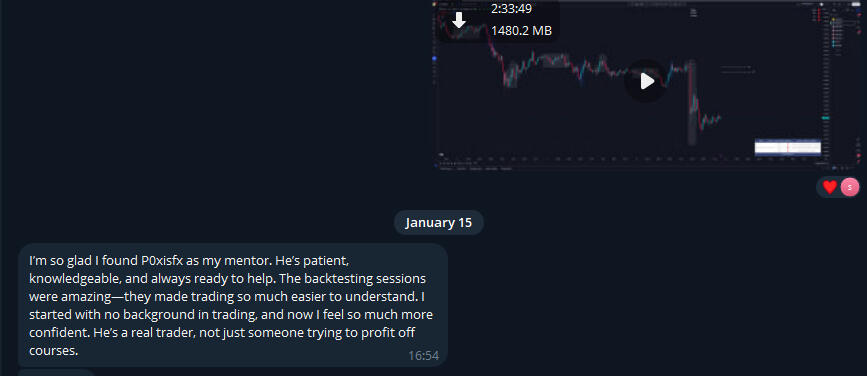

Mentorship & Guidance

What you will be learning:

You don’t have to figure this out alone. Get mentorship, trade breakdowns, and guidance designed to accelerate your learning curve, eliminate bad habits, and build real confidence in execution.

A proprietary market context framework

• A self-developed method for reading market context through higher-timeframe buyer and seller interaction, allowing you to align entries with dominant institutional pressure.

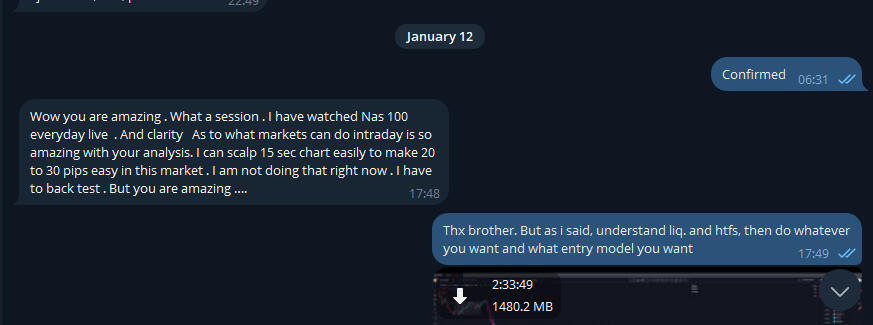

Pre-market plans, 3–5 days per week

• Clear directional bias, key levels, and execution scenarios before the session starts.

80+ in-depth educational videos

• A structured curriculum covering context, execution, risk, and trade management, built for traders who want consistency, not shortcuts.

Direct DM access to me

• Ask questions, get feedback, and remove confusion when it matters, not weeks later.

1:1 calls after completing the course

• Personalized reviews to correct execution errors, refine your process, and accelerate progress once the foundation is in place.

Mentorship until mastery

• Ongoing guidance and accountability until you can execute independently and consistently, typically 3–6 months.

Reach out via Telegram or the form below

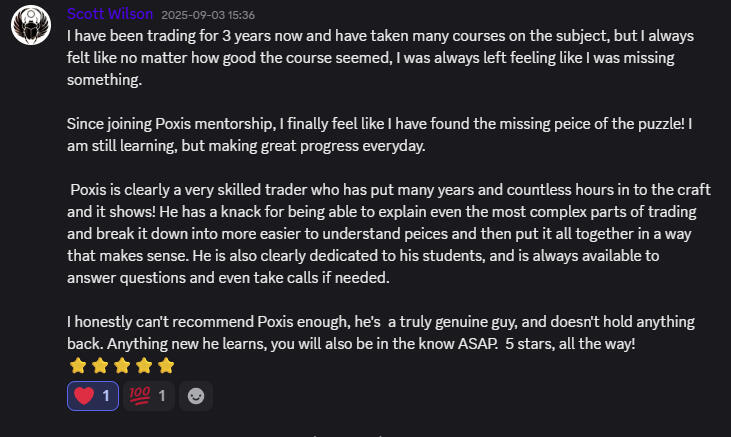

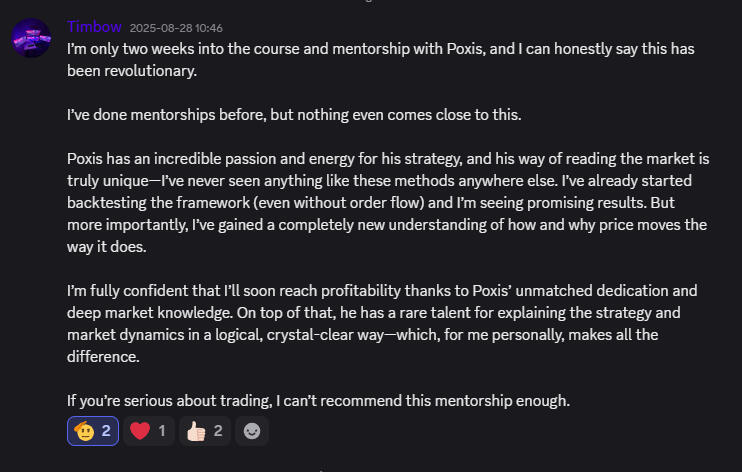

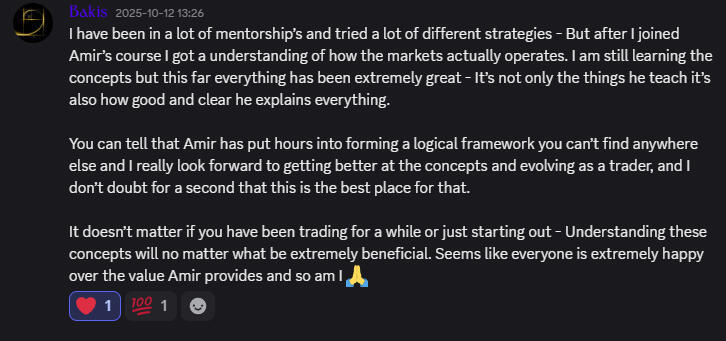

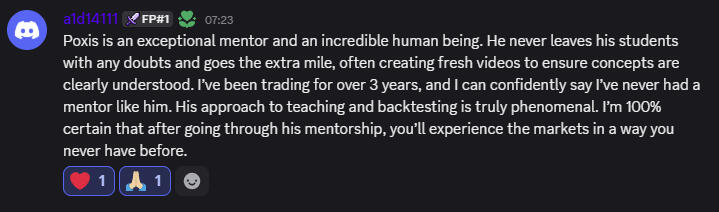

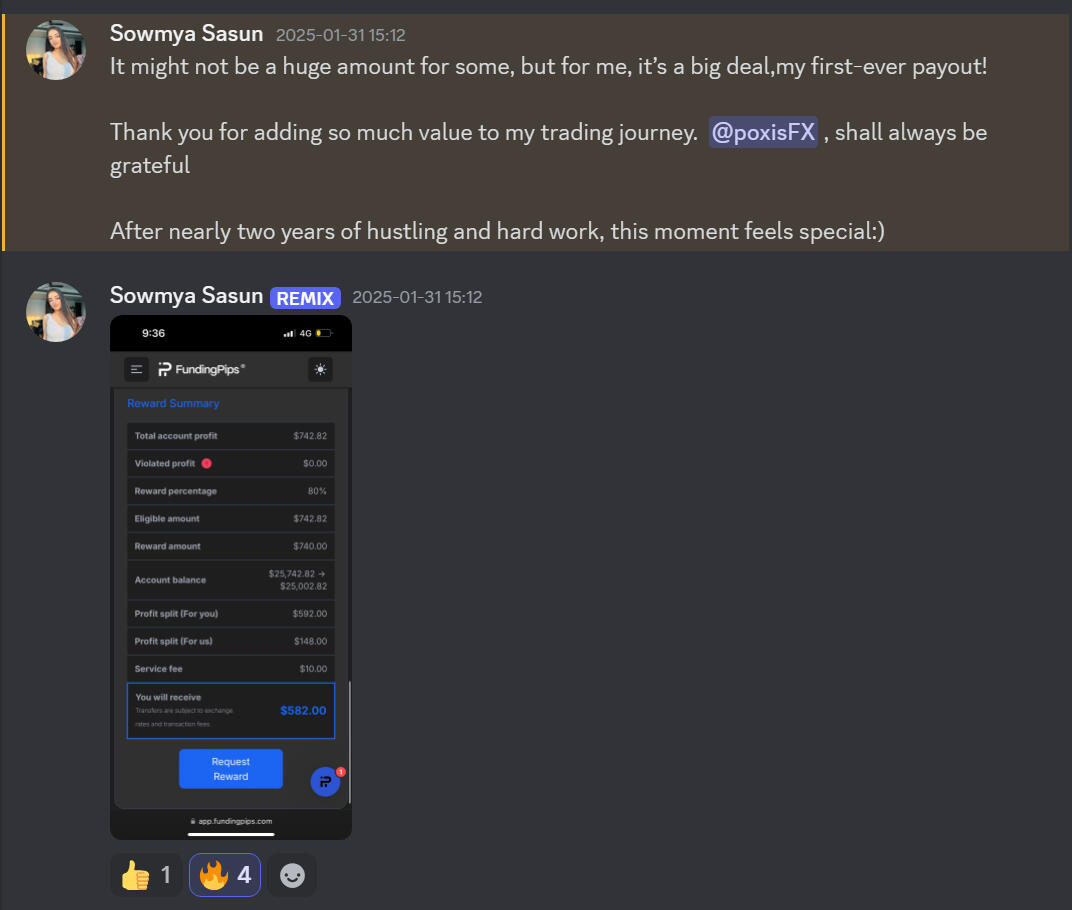

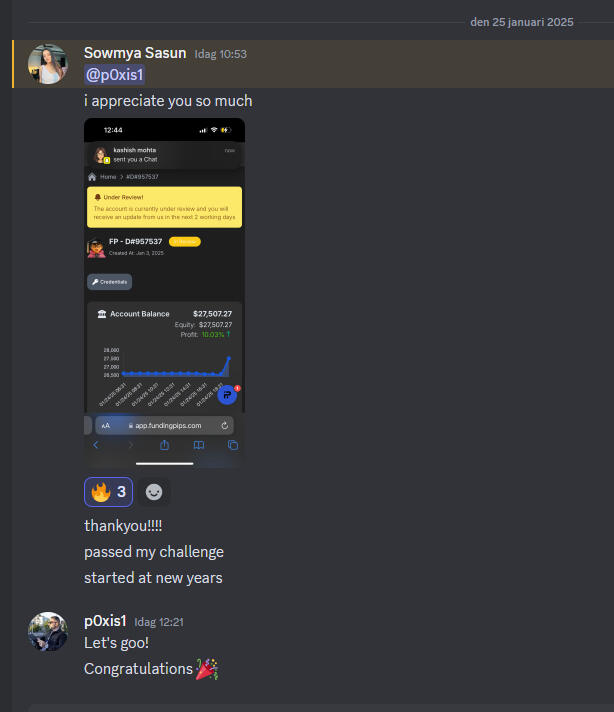

Testimonials

© poxisFX. All rights reserved.

To Enroll In The Empowered Trader's Academy

Or Book a Call